Whitecloud AI Strategies Explained

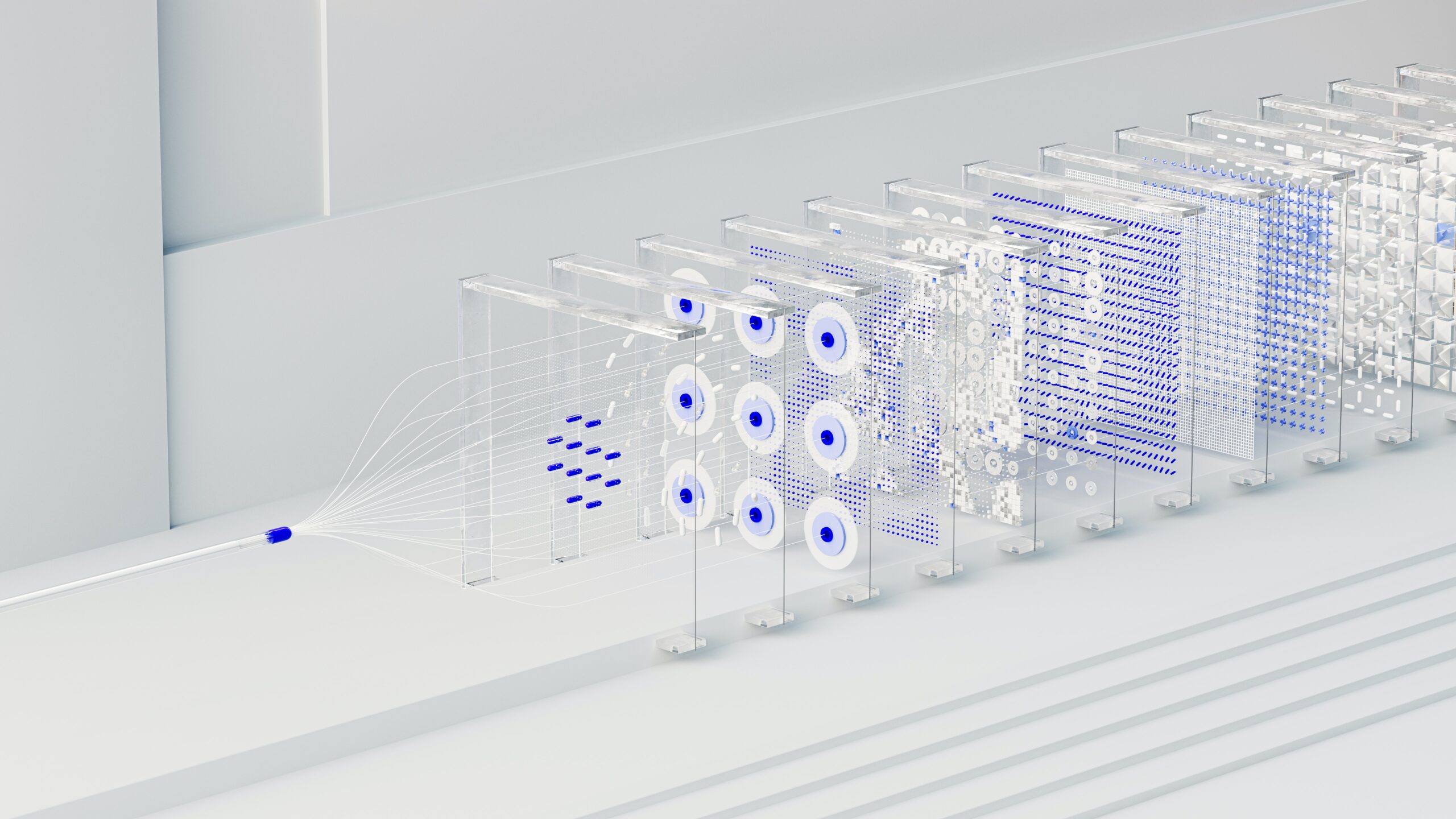

All our strategies are based on a highly sophisticated set of AI technologies. These have been developed, tested, and are running on live trading accounts over many years.

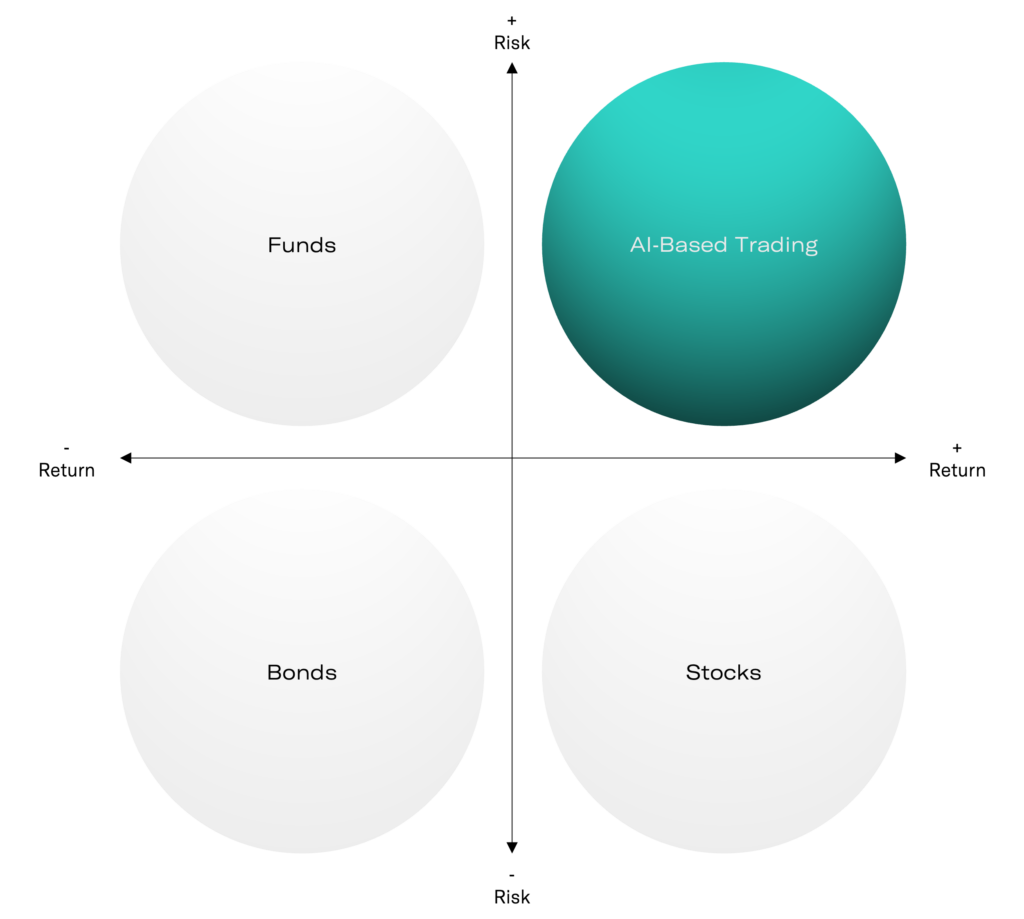

We at Whitecloud Capital offer small investors the opportunity to copy the transactions and performance of our institutional accounts. Each strategy features varying risks, returns, minimum balances, and trade management methodology, allowing users to select the strategy that best aligns with their investment goals and risk tolerance. We consider diversification to be the key to success in investing. All our strategies can therefore be used in combination without creating additional risk, since each trades different assets without any direct correlation.

The decision-making behind our trading methodology is based 100% on artificial intelligence and is defined by cutting edge machine learning models that run on our proprietary infrastructure. All our accounts feature advanced risk management to safeguard our user’s capital. Start from 500 € minimum investment only. Find out more about the available strategies below…

How Artificial Intelligence has influenced the financial world

By James Khaderi 3 Min

Artificial intelligence (AI) has revolutionised many industries, and trading and investing is no exception. AI algorithms have the potential to analyse large amounts of data, recognise patterns, and make decisions faster and more accurately than humans, leading to numerous benefits in the field of trading and investing.

One major benefit of AI in trading and investing is the ability to process vast amounts of data quickly and accurately. Financial markets generate enormous amounts of data every day, and human traders simply cannot process and analyse all of this information manually. AI algorithms, on the other hand, are able to quickly analyse and interpret vast amounts of data, enabling them to identify trends and patterns that may not be immediately apparent to humans. This can lead to more informed and accurate investment decisions, as well as the ability to make trades faster than humans.

Another benefit of AI in trading and investing is the ability to make decisions without emotional bias. Human traders are subject to a wide range of emotions, including fear, greed, and overconfidence, which can lead to poor decision making. AI algorithms, on the other hand, are not subject to emotional biases and can make decisions based solely on data and pre-determined rules, leading to more rational and unbiased investment decisions.

In addition to these benefits, AI can also improve risk management in trading and investing. AI algorithms are able to analyse and predict market trends and risks, enabling traders and investors to better manage their portfolio risk. This can help to minimise losses and maximise returns.

Despite the many benefits of AI in trading and investing, it is important to recognise that it is not a panacea. There are several fallacies of manual trading that AI algorithms can help to address, but they are not immune to making mistakes or encountering unforeseen circumstances.

One fallacy of manual trading is the belief that humans are better at making investment decisions than machines. While it is true that humans have unique qualities that machines do not, such as creativity and intuition, the vast amount of data that financial markets generate is simply too much for humans to process and analyse accurately. AI algorithms, on the other hand, are able to analyse and interpret large amounts of data quickly and accurately, leading to more informed and accurate investment decisions.

Another fallacy of manual trading is the belief that past performance is a reliable indicator of future performance. While it is certainly important to consider past performance when making investment decisions, it is important to recognise that past performance is not a guarantee of future results. AI algorithms are able to analyse and interpret large amounts of data and recognise patterns that may not be immediately apparent to humans, enabling them to make more accurate predictions about future market trends and risks.

In conclusion, AI has the potential to revolutionise trading and investing by enabling traders and investors to analyse and interpret vast amounts of data quickly and accurately, make decisions without emotional bias, and improve risk management. However, it is important to recognise that AI is not a panacea and is not immune to making mistakes or encountering unforeseen circumstances. By combining the strengths of humans and machines, traders and investors can make more informed and accurate investment decisions.

Sources:

https://www.investopedia.com/terms/a/artificial-intelligence-ai.asp

https://www.forbes.com/sites/forbestechcouncil/2019/05/14/the-advantages-and-disadvantages-of-artificial-intelligence-in-investing/?sh=46a07b924b91

https://www.investopedia.com/terms/a/artificial-intelligence-ai.asp